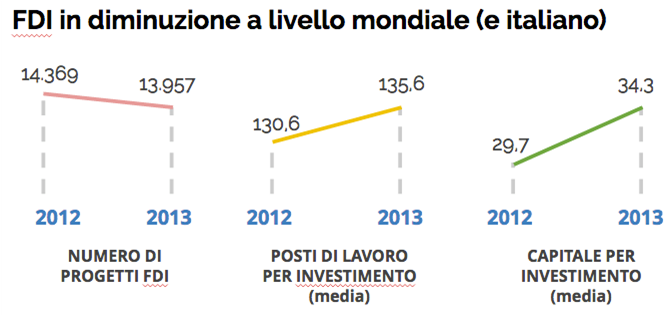

It is a well-known fact that the trend in foreign direct investments (FDI) mirrors the expansion or contraction dynamics that economic systems record over time. It is not surprising, therefore, that the economic crisis that began in 2008 has also had serious repercussions upon "greenfield" type investments, both globally and nationally: 13,957 FDI projects were created in 2013, 2.9% fewer than in 2012 and almost 19% fewer than in 2008.

The Asia-Pacific area remains the primary focus of foreign investors, followed by North and South America and Africa. Western Europe, on the other hand, has continued to lose its ability to attract foreign investments, recording just 22.2% of the total worldwide projects in 2013.

Amid this hostile scenario, Lombardy's performance stands out. Having always been considered "attractive" by foreign investors, over the past year this region seems to have become truly irresistible. With a 12% growth in the FDI projects implemented throughout the Region, Lombardy is one of the few areas on the old continent to boast a positive standing.

Lombardy has once again confirmed itself as the gateway for new lenders who are interested in developing business opportunities throughout Italy and the rest of Europe. The average geographical and sectoral distribution of the investments made over the past decade, on the other hand, are not surprising. In fact, the elaboration of the Invest in Lombardy event, based on FDI Intelligence data taken from The Financial Times, shows that out of 47 greenfield projects implemented throughout the national territory, over 70% were headquartered in Milan, with over 2/3 being focused upon the service sector, and an additional 5% and 6% respectively focusing upon the logistics and manufacturing sectors.

One final note regarding the start-up phenomenon. Although still at marginal levels, FDIs are increasing for start-ups focused upon innovation, R&D, design and prototyping. An additional factor that bodes well for the future growth of foreign direct investments: betting on knowledge-intensive sectors, in fact, provides for the retention of the best human resources, increases the available intellectual capital, and improves the territory's ability to make a positive difference in the contemporary competitive arena based on knowledge.