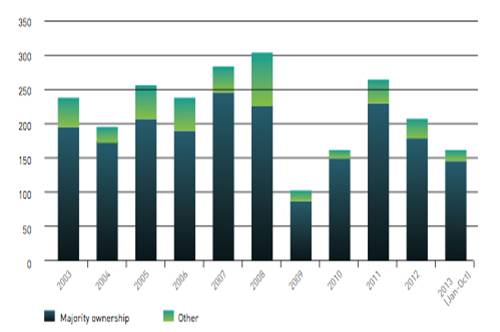

In all the industrialized countries, the majority of foreign direct investments are aimed at acquiring pre-existing companies (M&A transactions) rather than creating new businesses ( Greenfield). This general tendency also holds true in Lombardy: from 2003 to 2013, in fact, 2,400 Italian companies were either partially or completely acquired by foreign investors, and in over 80% of the M&A investments the multinational buyers obtained total control of the Italian investee companies.

Italian investee companies with at least 10% of the shares held by foreign multinationals (2003-2013)

In 2013, 29.3% of all the M&A transactions in Italy (acquisitions or shareholding acquisitions) were concentrated within Lombardy, as it represented the "Best Choice" for those looking to invest in our Country and gain a competitive foothold in Europe. The sectors in which the M&A transactions are mainly focused include "Manufacturing and Industry" (42.20%), "Wholesale and Retail" (22.10%) and "Business Services" (19.30%).

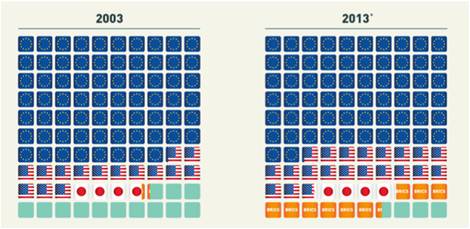

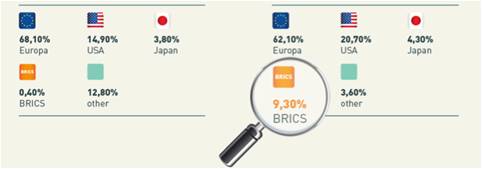

In the ranking of the countries most interested in investing in Italy, the European States and the United States remain firmly in the lead. The real news, however, are the BRICs: in just ten years time, the percentage of their investments has increased from 0.40% in 2003 to 9.30% in 2013. 2013 also witnessed an attenuation of the predominance of the Chinese investors that was recorded during the previous period: only M&A transactions are capable of fending off the Chinese.

Distribution of investors by country of origin: a comparison of 2003-2013.

The reasons for investment remain interesting: foreign companies are investing in Italy because they are drawn by qualified human resources and first class skills and technologies. Lombardy has thus confirmed itself as a valuable reservoir of excellence: an intangible asset capable of attracting investors from every corner of the globe.